Fintech

We are a financial software development company

We help the financial sector take daily and strategic operations to the next level by providing custom digital fintech solutions.

On time, right the first time, to help you to stay ahead of established brands.

We help you with:

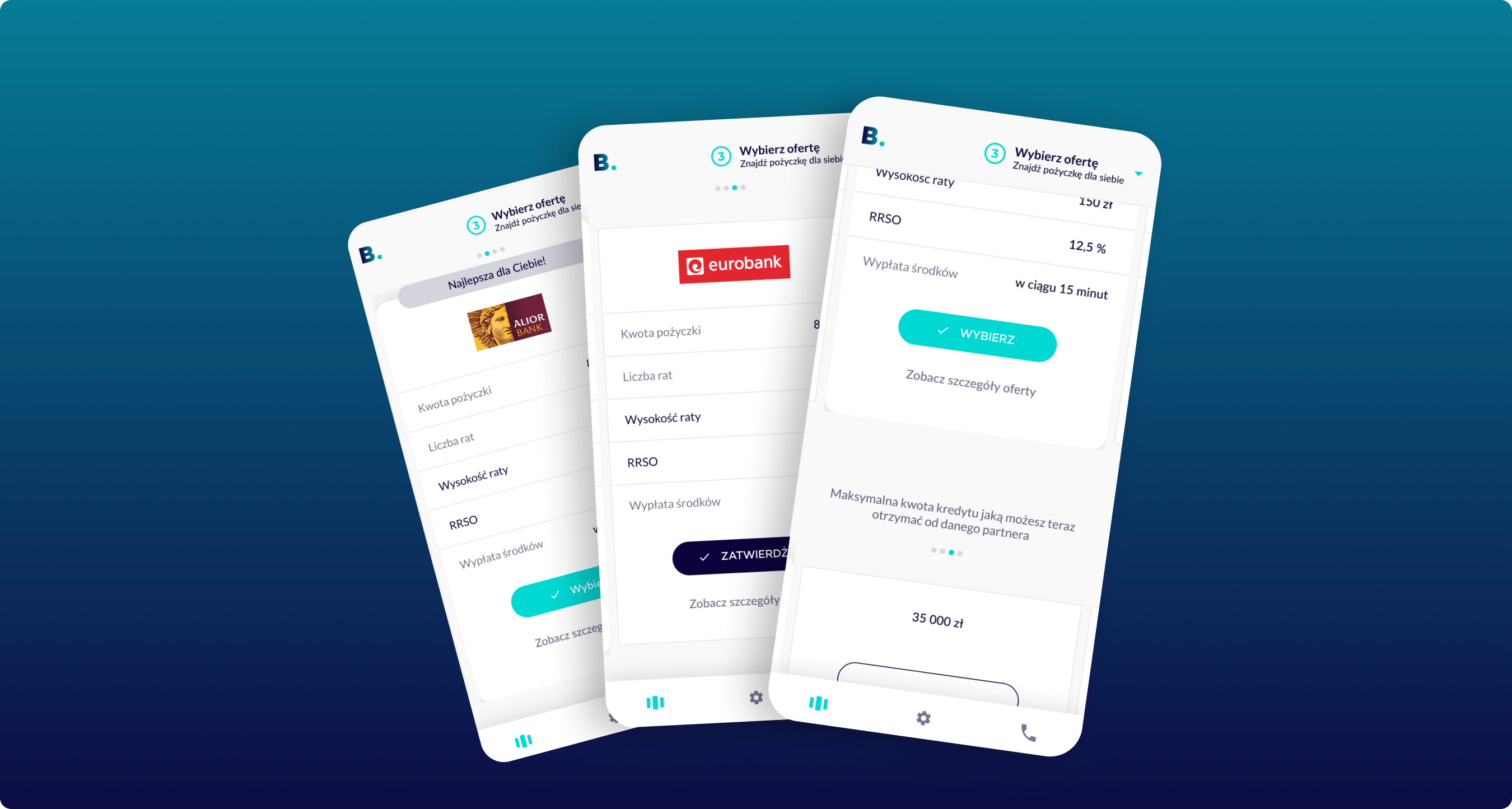

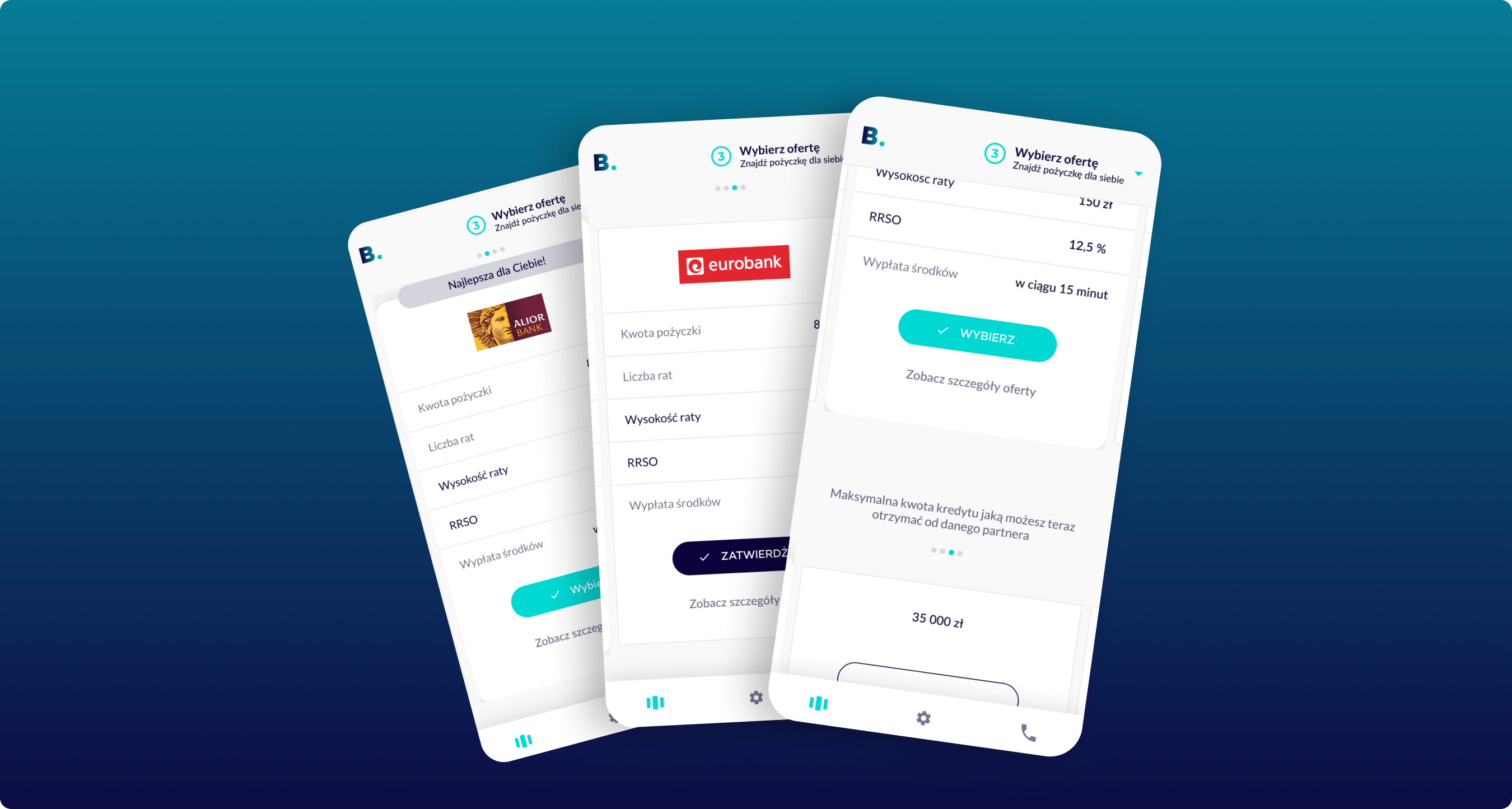

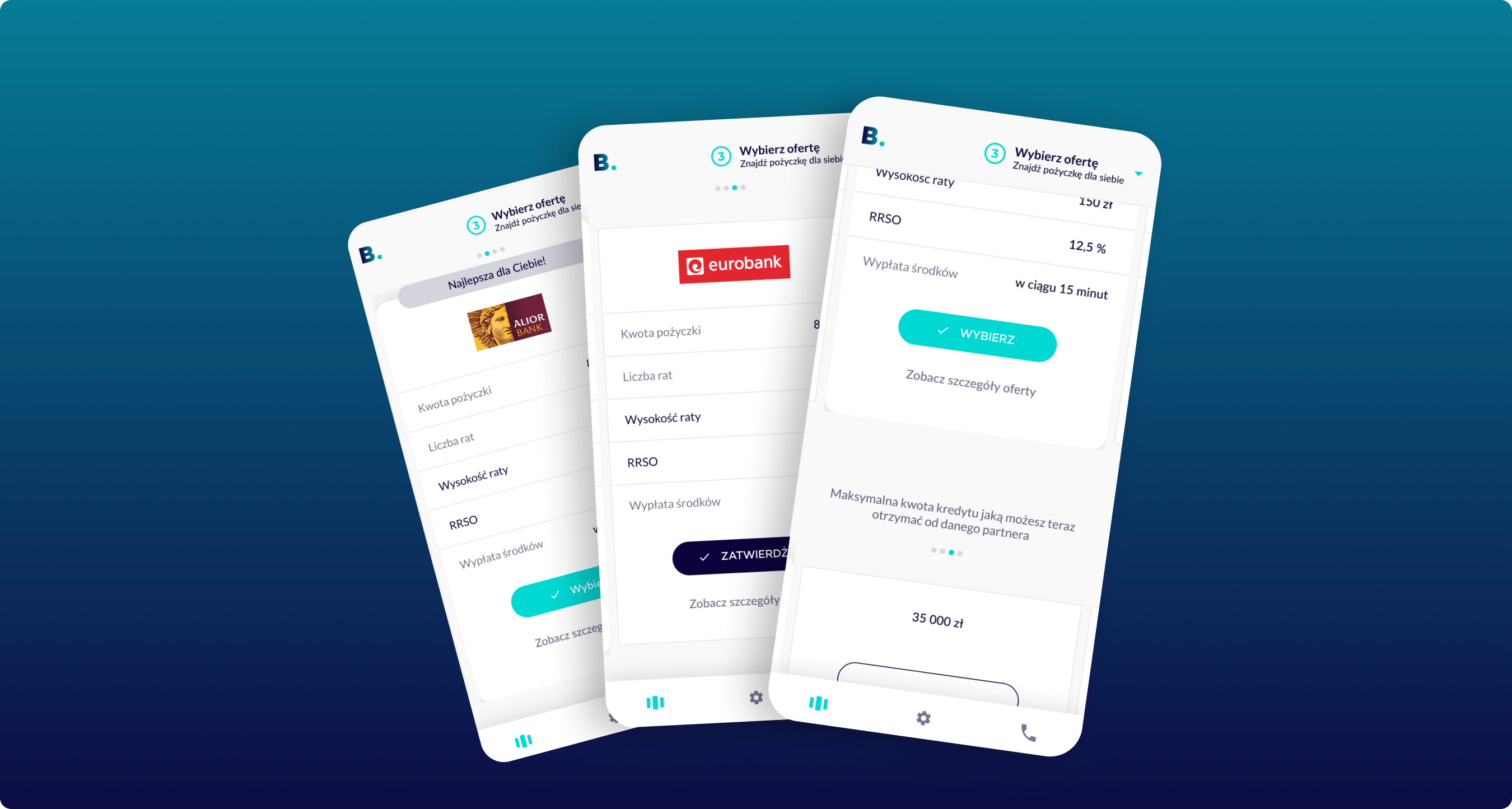

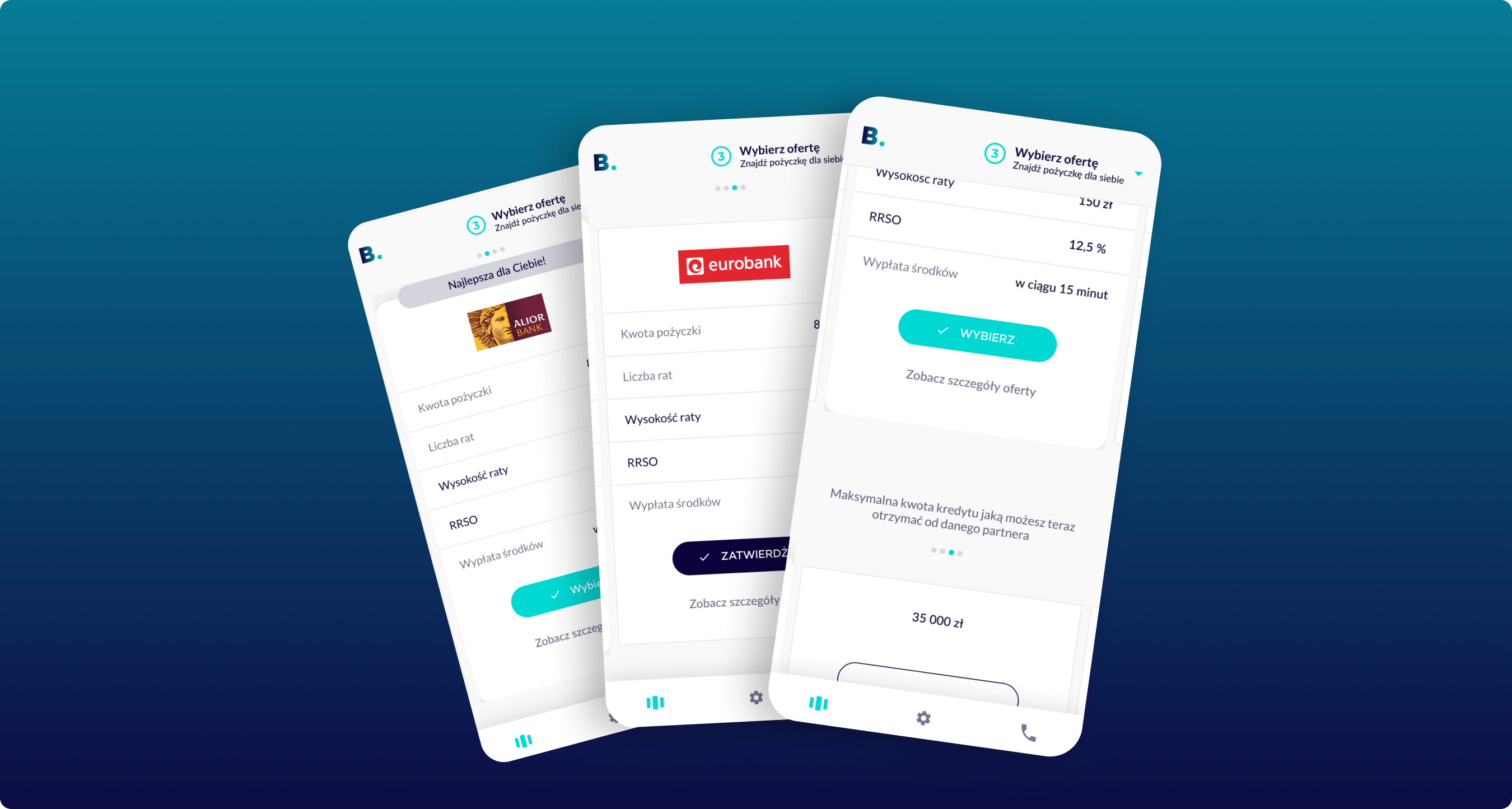

- Developing web and mobile fintech applications tailored to clients’ needs

- Building and optimising fintech solutions to enhance performance and attract users

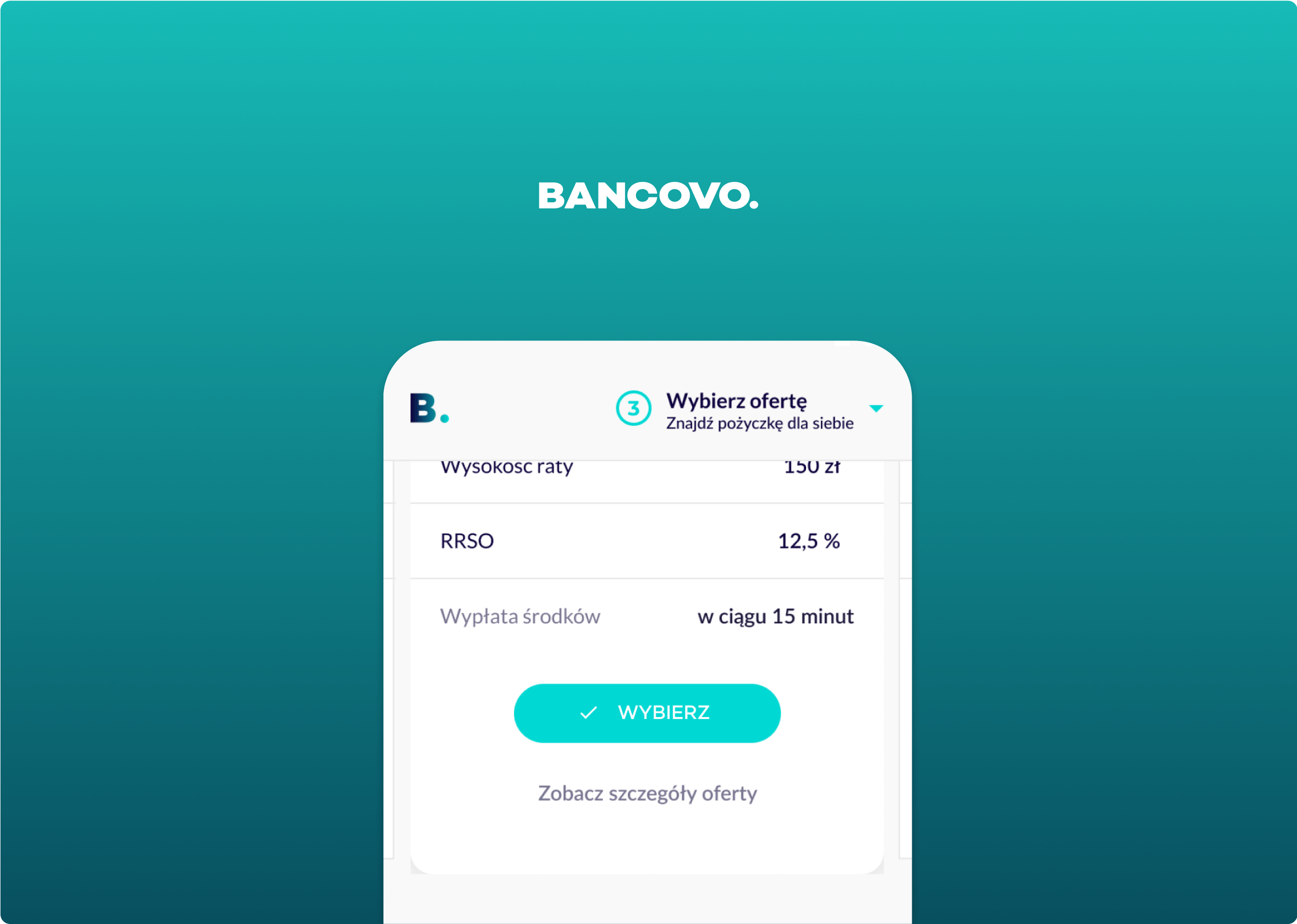

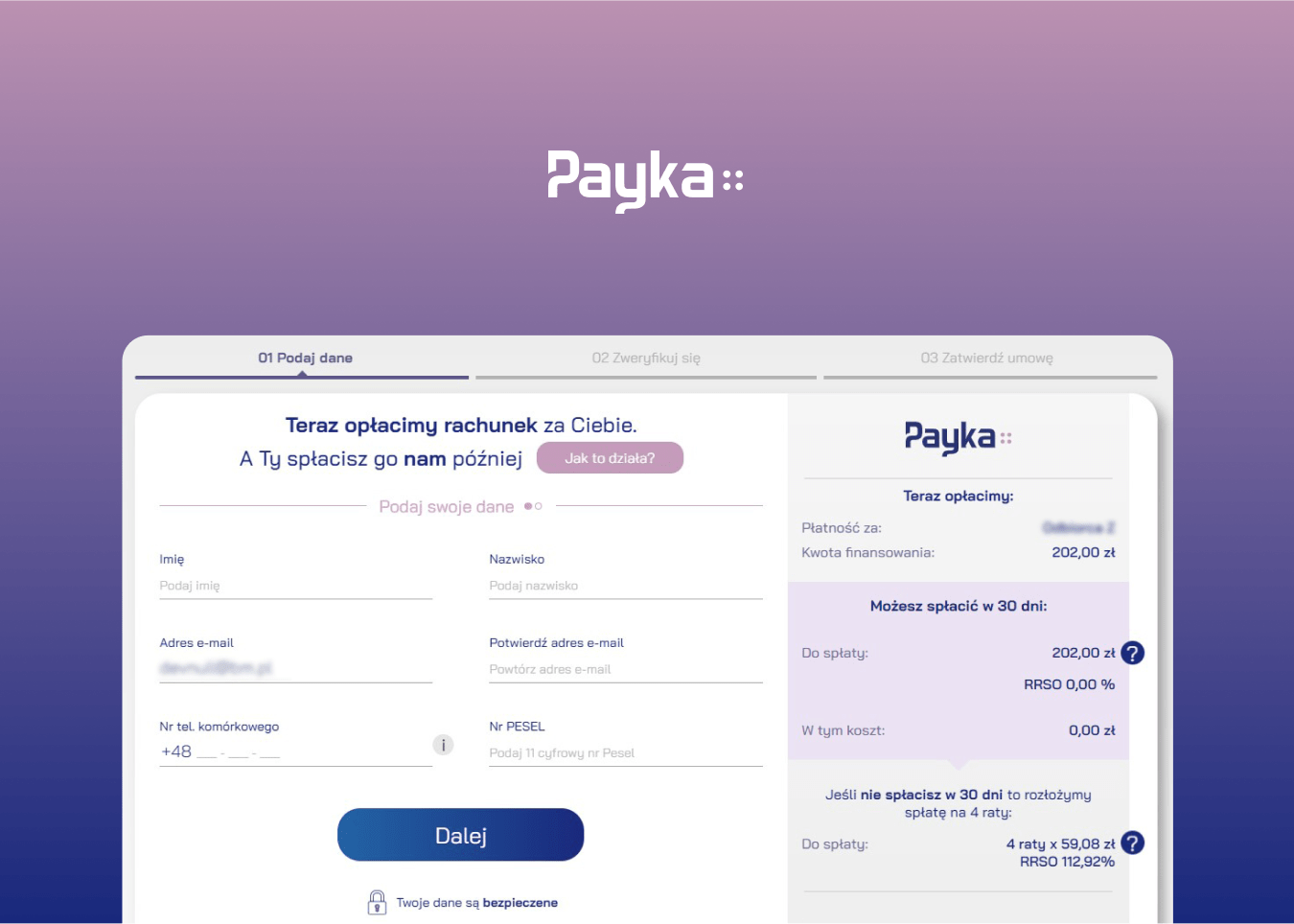

- Creating loan, credit, debit and money transaction solutions

- Designing and developing investment management applications

- Developing bespoke cards and payment solutions

- Implementing CMS, CRM and ECM platforms and solutions

- Conducting UX/UI audits and design to enhance usability

- Leveraging predictive analytics, data, and reporting tools

- Ensuring security and regulatory compliance across fintech solutions

Custom fintech software solutions

Speednet helps fintechs design and deliver seamless, omnichannel user experience across all touchpoints, collecting and leveraging customer data, shortening time-to-market, staying on top of software delivery costs and boosting predictability of delivery.

The combination of understanding the financial domain with 24+ years of technical expertise allows us to give you extremely precise time and cost estimates for your project.

Estimate your projectFill in a short contact form and we’ll get back to you via email within 1 hour.

Room for partnership and improvement

Research by Finastra suggests that banks will turn to fintechs for their challenges. Of almost 750 banking leaders worldwide, 56% want to use a network of integrated fintech solutions, with only 6% preferring to build functionality in-house. We believe that together, we can achieve more, so we build room for our clients to share good practices, knowledge and experiences. That is why we host an annual Finance Summit meeting of our Finance Club, connecting banks and fintechs to grow the industry.

Our approach to building world-class fintech solutions

We’re dedicated to creating exceptional fintech solutions. We do it by prioritising a few key factors during the cooperation process.

How do you challenge established brands and win a client?

Banks have some advantages over Fintechs, including capital, customer base, trust, regulatory expertise, data access, and partnership opportunities. We understand the fintech sector’s most important problems and know how to deliver solutions that impact the bottom line.

Our process of collaboration

We use a proven methodology of reliable and predictable software delivery.

Reviews

We’re tech specialists

We provide a comprehensive solution, from ideation to maintenance, including everything in between.

Schedule a free project estimate

Schedule a free project estimate

If you have a requirement you’d like to discuss with technical experts, schedule a free consultation to see if we’re a good fit to help.

Schedule a free project estimate

Schedule a free project estimate

If you have a requirement you’d like to discuss with technical experts, schedule a free consultation to see if we’re a good fit to help.