Banking

We are a Banking Software Development Company

We help the banking sector achieve operational efficiency, increased security coverage and provide seamless customer experience by delivering custom digital banking solutions. On time, right first time, to help you stay ahead on top of the market.

Areas of Banking expertise

We’re not only tech experts. Throughout the years of working with Europeans Banks, we’ve gathered consulting experience in the banking industry that helps us to truly innovate the banking ways of working in a relevant and meaningful way.

We can help you with:

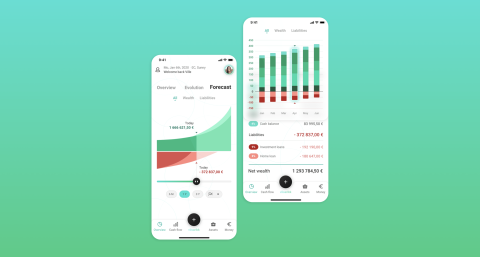

- Mobile banking

- Business logic layer (API / middleware)

- Payday loan solutions

- Mortgage credit platforms

- Wealth management systems

- Internet banking

- Corporate CMS

- VAS (Value-added services)

- Corporate banking

Value-added services examples:

Insurance cross-selling, currency exchange, admission tickets, public transport tickets, parking and highway fairs, invoice scanner, subscription manager, archiving invoices and bills, loyalty programs, spendings analysis, split-a-bill feature

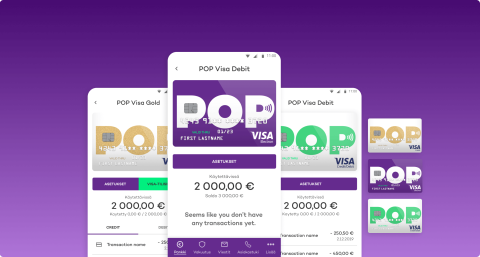

6+ years of collaboration️

Learn more about this case studyIt became clear from the early stages of the project that Speednet was a partner extremely committed to delivering high-quality software. Speednet was able to create an elegant, top-quality project, where the priority is always the best customer experience. The appearance of the application was very well received by POP Pankki customers.

Custom banking software solutions

Speednet can help your Bank with optimizing, digitalising and automating financial processes. By combining technical expertise, in-depth banking industry understanding and ease of uncovering true end-user needs, we deliver software solutions that boost customer engagement, increase time-to-market and reduce operating costs.

Process of collaboration

Every customer has different needs. We have built and tested a process of collaboration that ensures smooth kick-off and efficient delivery of a solution that is really needed by both stakeholders and end-users.

In some cases only parts of the process are relevant. We believe that knowledge and experience combined flexibility and operational agility allow us to adapt to each customer scenario. Here’s how we usually deal with it:

Our approach to building world-class banking solutions

We’re dedicated to creating exceptional banking solutions by prioritizng a few key factors during the cooperation process.

Models of collaboration

Our goal is to adapt to your expectations and needs. That includes the engagement model. We offer different cooperation models to adjust to every project type – you can choose the one you prefer to work with or suggest an alternative.

Let’s discuss

Let’s discuss

If you have a requirement you’d like to discuss with technical experts, schedule a free consultation to see if we’re a good fit to help.

Let’s discuss how we can work together to achieve your goals

Let’s discuss how we can work together to achieve your goals

If you have a requirement you’d like to discuss with technical experts, schedule a free consultation to see if we’re a good fit to help.